It's getting tough out there! Here are some handy money tips to reach your savings goals faster.

It’s getting tough out there! Here are some handy money tips to reach your savings goals faster.

No one needs reminding that the financial squeeze is on, particularly for those managing a mortgage. And for those looking to enter the property market, achieving that dream can feel a bit like catching a rainbow – always just out of reach.

However, there are a number of practical ways to help reach your financial goals – and they’re not all about cutting out the good stuff in life! It just takes a little organisation and discipline, and keeping your eye on the prize. Even for those on a low income, there are things you can do to make those savings grow.

We’ve put together some handy tips and advice to get you started. But before you do start, it’s important to know what your goal is and to have a budget. A budget is the foundation for any savings plan, and it’s very hard to save without one.

1. Unsubscribe

Do you even know how many subscriptions you are paying for automatically every month? From unused gym memberships to streaming services, there is bound to be a few dollars saved each month by hitting ‘unsubscribe’. It can be very satisfying!

2. Turn the lights off!

You know how it works! Turning off power when it’s not needed - lights, air conditioners, appliances - may not feel like it’s making a huge difference on its own, but it all adds up. Energy bills make up a significant part of the household budget. (Do you really need the aircon on all night?? That second fridge?)

3. Eat to save

Restaurant meals, café lunches, meal deliveries … add it up, and it takes a hefty whack out of your budget. Healthy home cooking can save you big bucks, especially if you plan ahead and shop well to avoid waste. Cook ahead, freeze portions, and take lunch to work. Leftovers, anyone?

4. Spend-nothing months

It’s a challenge, but give it a go! Set yourself the target of zero expenses for a month, outside of groceries and utilities. Put away the credit card. Cook at home, invite friends over for a movie, borrow books from friends or the library, have an alcohol-free month, look in the back of your wardrobe if you’re bored with your clothes (there’s bound to be something there you haven’t worn yet!). You can do it – it’s only a month, and who knows, you may develop some healthy habits that last a lifetime!

5. Repair, don’t replace

This is an old-school approach, but one your parents and grandparents will be familiar with. You’ll be amazed at how many items you can repair, avoiding the need to buy new ‘stuff’. A needle and thread, a friendly bootmaker, a screwdriver kit, a tube of super glue. Google ‘Repair Café’ to see if there’s one near you. All this is great for the environment, too, when we’re not constantly chucking things out to landfill.

6. Embrace the freebie

Take the time to look for the many deals, offers, coupons out there. If you need to buy anything, try and do it when it’s on sale. Check the discount brochures, shop around, find deals online, or browse your local op shops. (Don’t buy stuff just because it’s a good deal, though – that’s a number one savings myth!)

In a nutshell:

- The best way to save money quickly is to cut back from unnecessary expenses – a gym membership you’re not using, café lunches on workdays, running a second fridge.

- Find new ways to increase your income. Are you eligible for any government benefits? Can you rent a room, mow a lawn, babysit, run a craft stall, take a weekend job?

- Start small. Think about putting 5% of your income away into a separate savings account as soon as you get paid. You can always increase it later, when you get better at saving!

- Stay focused. It will happen!

Of course, all of this is general advice only. If you’re looking seriously at saving or borrowing money, talk to a bank or finance professional.

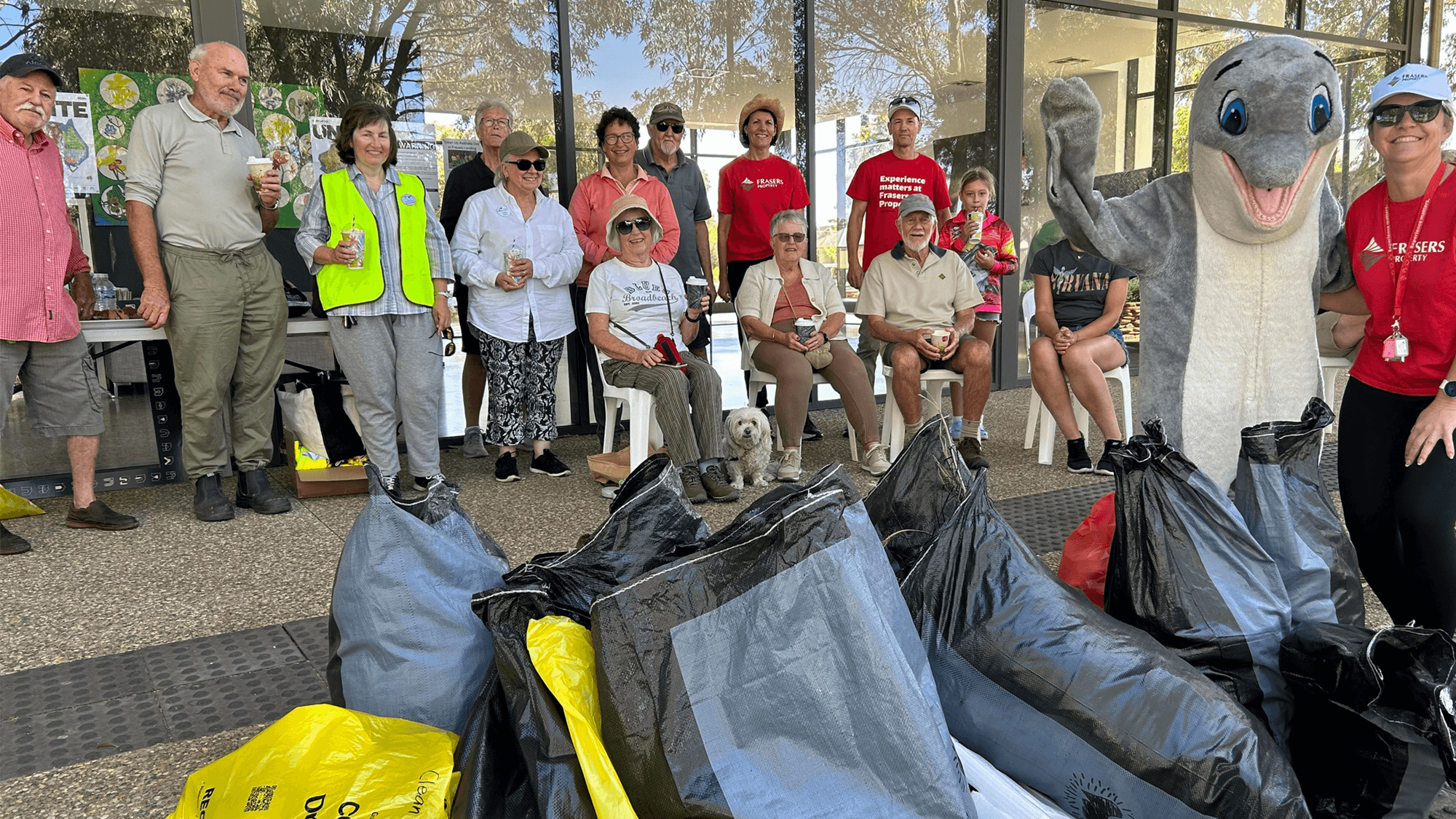

And if you’d like information about living at Frasers Landing, email Kaylene at kaylene.mcternan@frasersproperty.com.au or call 13 38 38.

Source: We got our info from www.moneysmart.gov.au/saving/save-for-a-house-deposit

and www.hrblock.com.au/tax-academy/save-money-low-income

See more articles on