FIRST HOME BUYER HUB

Find all the information you need as a first home buyer to make your new home purchase at Midtown.

Welcome to the first home buyer hub

Buying your first home is one of the proudest achievements in life. But before you get the keys to your new home, there are a lot of elements you need to consider. Our guides below will help you make your first property purchase with confidence.

Your first home buying guide

First Home Buyer Guide

Find all the information you need as a first home buyer to make your new home purchase a proud one.

View guide

Tips for First Home Buyer

For contracts that exchange on or after 1 July 2023, eligible first home buyers will receive an exemption from stamp duty for purchases of new and existing homes up to $800,000 and a concessional rate of duty for homes up to $1,000,000. To be eligible for the First Home Buyer Assistance Scheme:

- the purchase must be for a new or existing home in NSW.

- the property value must be within the threshold amounts.

- the transfer must be for the whole property.

- you must be an individual, (not a company or trust*)

- you must be over 18*

- you and your spouse or partner, must never have owned or co-owned residential property in Australia.

- you and your spouse or partner, must never have previously received an exemption or concession under the scheme.

- at least one of the first home buyers must be an Australian citizen or permanent resident.

Find out more, click here

- Be organised. Get all of your documentation, identification, and other details ready. Home loan approval delays can often be the result of missing, out of date, or incorrect documents or information.

- Be upfront with information. Provide all the necessary documents upfront and convey as much detail as possible about your requirements and objectives and have good, current information on your financial position.

- Get pre-approval. Properties are selling fast, and there are plenty of buyers in the market. Organise your pre-approval so that when you’re ready to put in an offer, formal approval can usually be a less stressful and more streamlined experience.

- Reduce or eliminate other debts and excess expenses. Lenders will look at several months’ worth of living expenses to see how you spend, so work on minimising unnecessary spending. They’ll also consider existing loan repayments during the approval process. The simpler these are to verify the smoother the application process.

Put simply, Lender’s Mortgage Insurance (LMI) is insurance that protects the lender if, for some reason, you are unable to make your repayments.

LMI will generally be applied if you borrow more than 80% of the purchase price of your home, so it’s actually a good thing for First Home Buyers as it’s a way for you to obtain finance with a smaller deposit.

The cost of LMI will depend on how much deposit you have saved up, and the purchase price. A mortgage broker will be able to give you an estimate when you’re going through the process of obtaining pre-approval.

An off the plan property can generally be secured with a 10% deposit at contract signing time. The balance of the purchase then doesn’t need to be paid until your home is complete, giving you additional time to save. There are plenty of other benefits as well, including:

- You’re more likely to qualify for Government Assistance

- There may be more tax depreciation on new properties

- Early purchasers will enjoy a greater selection of what’s available in a building that meets your criteria considering view, aspect and preferred floorplan

- Buying off the plan will generally involve an extended settlement period giving you more time to save and get prepared for moving into your new home!

Reintvesting is the term for renting where you want to live, and purchasing an investment property where you can afford to buy. This is becoming increasingly popular with first home buyers, especially in Sydney and Melbourne where suburbs close to the CBD are priced out of reach for many. It allows you to continue living the lifestyle you love, while still getting onto the property ladder.

Across Australia, there are consistent themes as to what drives choice of where and how people live. A great lifestyle, available jobs and housing affordability are all driving these choices. There’s generally a strong preference for the traditional, large family home, however increasingly people are making trade-offs and putting lifestyle ahead of space, to ensure they’re making the best purchase that suits the way they live.

Proximity to transport, shopping, cafes, education, and parks is important to weigh up and think about what you will need now and into the future. Generally, properties that are close to amenities such as these make for better investments long term.

It differs for everyone, and there are no guarantees with any investment. However as most of us are generally poor savers, it makes sense to invest your income in a way that benefits you the most – a roof over your head. Everyone needs to live somewhere, and being a long term renter is tough, especially if you have plans to grow your family in the future.

If you buy with a long term view, usually you can benefit from capital growth in your investment which then gives you a significant edge once you reach retirement age. You’re probably not thinking that far ahead, but it’s worth taking it into consideration to ensure you have all the information you need.

Finally, there’s nothing like the sense of pride that comes with owning your own home. After almost a century of creating homes and places for tens of thousands of Australians, experience tells us that what matters the most is the simple joy of living in a place you’re proud to call home.

Speak with our property partners today

Let our property partners help you on your journey to buying your first home. We have finance partners who can assess your financial situation or our legal partners to provide you with the legal guidance you need through the purchase of your new home.

Astute Finance

Your finance experts

Our home finance experts Astute finance have extensive experience working with lenders, allowing them to review your financial needs against a lending panel and present you with simple, straightforward solutions to your individual needs.

Find out more

Bugden Allen Graham Lawyers

Your property law experts

Experts in property law, Bugden Allen Graham Lawyers, can guide you through the contractual requirements and any legal queries you have for purchasing your new home.

Find out more

Your dedicated team at Midtown

Customer Care team

- Personalised care and expert support from our Customer Care team.

- Committed to ensuring your customer journey with us is easy and enjoyable.

- Providing the latest progress updates & information, from the start of construction to settlement and long after moving in.

- Offering friendly guidance and support, either in-person or from the myFrasersProperty app and portal.

Community Development team

- Experienced Community Development specialist providing welcoming and accessible events and programs.

- Works alongside residents to co-create communities that are supported to fulfill their potential.

- Promotes inclusive communities where people authentically feel like they belong.

- Builds community resilience so residence feel empowered and self-reliant.

Property Management

Frasers Property Management

- Specialised knowledge with over 95 years of experience in Australia.

- Access to Frasers Property's extensive resources, networks, and databases.

- Offers exclusive pre-settlement leasing for properties purchased with Frasers Property.

- Hassles free with all paperwork and tax requirements, and more.

Meet Midtown’s new residents

We know there are more facilities coming like a primary school and childcare just downstairs.

Buying with Frasers was an excellent experience. I want to do it again long term, as a possible investment.

Midtown MacPark to me is a dream come true, that’s the place where I want to raise my baby.

The greenery and the park spaces and the walking spaces and it seemed like a great fit for the new life I’m about to start.

We knew that we were dealing with a good company, a good developer, a serious one. For us, it means happiness, home and new life.

Find your dream home today at Midtown

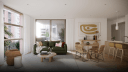

*Disclaimer: above image is artist’s impression, indicative only. Timber flooring and kitchen pendant lighting are optional upgrades and not included in price list.

Visit Midtown Sales & Display Centre

ADDRESS

2 Mahogany Avenue,Macquarie Park NSW 2113

OPENING TIMES:

4 days, Tuesday to Friday (closed Saturday to Monday)11am - 2pm

Enquire now