INVESTOR HUB

Explore our new investor hub and get all the information you need to buy with confidence.

Welcome to the investor hub

As an investor it is important to know all your options and to partner with a developer that you can trust and rely on for your investment purchase. With almost 100 years of experience in the industry, Frasers Property is committed to providing you with the support and guidance you need for a successful investment.

Invest in Macquarie Park’s bright future

Sydney's northwest is a priority region that is already playing a valuable role in the city's future growth. And right in the heart, you'll find Macquarie Park – the third largest business district in NSW and a highly liveable and connected location, close to employment hubs, transport connections, a world-class university, shopping and entertainment, as well as an abundance of green open space.

By new approaches to housing and diverse public spaces, Midtown MacPark is your opportunity to invest in a bright future. A walkable neighbourhood in the heart of Macquarie Park, with everything you need – a new primary school, two childcare centres, cafés and shops, parks and playgrounds, a pay-as-you-go pool and gym, a community garden and a community centre where everyone can get together.

View Investor Guide

Why invest in Midtown

Benefiting from several major infrastructure projects across transport, education, retail and civic facilities totalling around $15 billion, Macquarie Park is an area under transformation and Midtown is your opportunity to invest in a bright future. As the third-largest business district in NSW, Macquarie Park is a highly liveable and connected location. It offers easy access to everything you need to live, work, shop, and move around, as well as a range of world-class education facilities.

Learn the lingo

Here are some key terms and concepts you'll want to be familiar with.

If you’re using a property as an income-generating asset (i.e. rent from tenants) you can claim a depreciation deduction on that asset against the income you’ve earned. When it comes to what and how much you can claim, it all depends on how old the property is or how much improvement you’ve done to it. Brand new properties can be depreciated for a full forty years, which tends to make them attractive for investors.

It’s a good idea to talk to a quantity surveyor to understand exactly what you can depreciate on your property. They can produce depreciation schedules that will help make your claim easier at tax time.

Equity is the difference between what you owe on a property and its market value. Normally equity grows as you pay back a loan - effectively it’s the part you ‘own’. And it might be something you can access to buy another property without having to save a deposit again.

This is when you borrow money to buy an investment property and the income from that investment is less than what it cost you to generate it. Costs can include interest on the loan and expenses required to keep the property in good working order.

So, is this a bad thing? Not if you expect to offset your losses with a capital gain as the property’s value increases over time. And in the meantime, your investment loss reduces your taxable income and therefore the amount of tax you need to pay.

Many investors choose to employ the services of a property management company to deal directly with tenants and take care of essential tasks like finding a tenant, rent collection, handling maintenance and repairs, and ensuring all paperwork is in order.

Property managers can save you a great deal of time and stress, but they are an extra expense and quality of service can vary considerably, so it’s important to do your research.

Rentvesting is a popular option for first home buyers who can’t quite afford to buy in their ideal suburb just yet. Put simply, buyers rent a home in the suburb where they want to live and buy in a suburb where they can afford, renting that property to a tenant.

For some, this is the compromise that allows them to live the life they want while using spare funds to build equity in their investment property. However, there are a number of tax implications to this arrangement that you should understand, so it’s best to sit down with a financial advisor before buying.

If you choose to buy an apartment or townhome, you’ll need to be familiar with Strata. This model of property ownership allows for individual ownership of part of a property (your apartment or townhome), combined with the shared ownership of common areas like foyers and gardens through an owner’s corporation or body corporate.

All owners in the scheme are required to pay levies. Levies are usually charged quarterly and sometimes on an annual basis and go towards the administration and upkeep of the scheme and any required works, scheduled or emergency.

Comprehensive property investor guide

Looking to enhance your property investment strategies? Our comprehensive guide for property investors offers a wealth of valuable tips, insights, and tools to help you make well-informed decisions and maximise your investment potential.

Tips and tools for investors

Care that lasts a lifetime

Care & Rewards program

Our Care & Rewards program is designed with you in mind to ensure you feel proud of the choice you’ve made to invest with Frasers Property. Whether you are a first home buyer or experienced investor, you will receive personalised care and expert support from one of our dedicated Customer Care Team and the ability to manage your property from the myFrasersProperty app and portal.

Find out moreProperty Management Services

Frasers Property Management is committed to expertly managing your investment property. Our team of skilled professionals provides personalized service and takes care of every aspect of your property, from finding tenants to managing paperwork and tax requirements. Trust us to make your real estate investment a success.

Find out more

Invest in Midtown's bright future

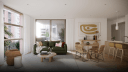

*Disclaimer: image above is artist’s impression, indicative only. Timber flooring and kitchen pendant lighting are optional upgrades and not included in price list.

Visit Midtown Sales & Display Centre

ADDRESS

2 Mahogany Avenue,Macquarie Park NSW 2113

OPENING TIMES:

4 days, Tuesday to Friday (closed Saturday to Monday)11am - 2pm

Enquire now