How the 5% First Home Guarantee Helps You Buy at Ed.Square

The 5% First Home Deposit Scheme Arrives Early – What This Means for You at Ed.Square

If you’ve been saving for your first home, there’s great news. As of 1 October 2025, the Australian Government’s First Home Guarantee Scheme lets you buy a brand new apartment, terrace, or townhome at Ed.Square with just a 5% deposit. Even better, you won’t have to pay Lenders’ Mortgage Insurance (LMI). This is a big step towards making home ownership more affordable, especially for first home buyers looking for a connected, welcoming community like Ed.Square.

What’s New for First Home Buyers?

Here’s what you need to know:

- Start date: The 5% deposit scheme is available from 1 October 2025.

- Deposit: You can secure your new Ed.Square home with just 5% down.

- No income caps: The scheme is open to all first home buyers, no matter your household income.

- Unlimited places: There’s no limit on the number of people who can apply.

- Higher property price caps: In Sydney, you can buy a property valued up to $1.5 million, meaning new homes for sale at Ed.Square are within reach.

In short, more first home buyers can use the expanded Home Guarantee Scheme, and more properties at Ed.Square are eligible.

How Much Could You Save?

The difference between a 20% deposit and a 5% deposit is huge. As of July 2025, Sydney’s median house price is $1.564 million. A 20% deposit would mean saving $312,800. With the new scheme, you only need $78,200. That’s more than $230,000 in upfront savings. This means you could move into your new Ed.Square home years sooner, without the stress of saving a massive deposit.

What About Lenders’ Mortgage Insurance (LMI)?

Skipping LMI can save you tens of thousands of dollars—money you can put towards your new home or your lifestyle at Ed.Square, instead of fees.

Most first home buyers have heard of LMI, but many don’t realise how much it adds to the cost of buying. LMI is an insurance policy that protects the lender, not you, if you can’t keep up with your repayments. Traditionally, if you didn’t have a 20% deposit, your bank would require you to pay LMI on top of your home loan.

For first home buyers already stretched to save a deposit, this could mean tens of thousands of dollars extra upfront. For example, someone buying a $700,000 property with a 10% deposit could face LMI of up to $20,000–$25,000, depending on the lender. On a $1 million property, LMI could go well above $40,000. While the cost was usually rolled into the mortgage, it still meant higher repayments and years of paying interest on an expense that doesn’t add value to your home.

With the 5% deposit scheme, you can avoid LMI altogether, helping you get into the market sooner and dodge one of the biggest hidden costs of buying your first home.

What Does This Mean for Your Ed.Square Journey?

With a range of 1, 2 and 3 bedroom terrace homes now selling, all priced under the $1.5 million price cap, Ed.Square is ready to welcome you. Here’s how to make the most of the scheme:

- Check your eligibility: Use the Housing Australia online tool.

- Talk to lenders early: Many banks and customer-owned lenders will offer loans under the Home Guarantee Scheme.

- Get your deposit ready: Aim for 5% of your target property price, plus allow for stamp duty and other upfront costs. As a first home buyer, you might also be eligible for a stamp duty exemption or concession—check the NSW Government website for details.

- Stick to your budget: Plan for repayments that are comfortable long-term. Keep in mind the property price caps for your region and the range of homes available at Ed.Square.

Why Ed.Square?

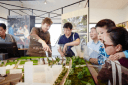

Ed.Square isn’t just a place to live—it’s a vibrant, masterplanned community designed for modern living. Developed by Frasers Property Australia, Ed.Square offers:

- A range of new homes: Choose from stylish apartments, terraces, and townhomes, all designed for comfort and flexibility.

- Lifestyle and convenience: Enjoy the Ed.Square Town Centre, with supermarkets, specialty stores, cafes, restaurants, and a cinema right on your doorstep.

- Community and belonging: Meet your neighbours in communal gardens, BBQ areas, and social spaces. Regular events and activities help you feel at home from day one.

- Sustainability: Green spaces, tree-lined streets, and water-wise landscaping are at the heart of the community.

Next Steps?

Buying your first home can feel overwhelming, but Ed.Square and Frasers Property Australia are here to support you every step of the way. Our First Home Buyer Guide covers everything from saving and finance to choosing the right home and understanding the buying process. It’s your practical companion for a smooth and confident journey into home ownership.

Ready to start your next chapter? Explore available homes at Ed.Square, discover the benefits of the First Home Guarantee scheme, and take the first step towards living your dream.

Disclaimer: All opinions, estimates, forecasts, links to external websites, conclusions and recommendations and underlying assumptions contained within this article are made and expressed by Frasers in good faith, in the reasonable belief they are correct and not misleading as at the date of publication. Deposit and LMI saving estimates are provided as a general guide only and do not constitute advice. Actual figures or deposit or LMI savings may vary depending on your individual circumstances and eligibility for any government grants. Please visit the relevant state government website on first homeowners grants and check eligibility. This publication and its content do not represent financial or other professional advice and should not be regarded as such. Before acting on any information provided, you should fully consider the appropriateness of the information, having regard to your objectives, financial or taxation situation and needs and, if necessary, seek appropriate professional advice.

See more articles on