Tenants investors descend on south west Sydney

Investors and tenants have flocked to a new apartment development in Sydney’s south west, providing a stark contrast to surging rental vacancies in the inner city and providing an insight into potential tenant behaviour post-pandemic.

Frasers Property Australia said it had received more than 240 rental registrations at its Ed.Square mixed use project over the last two months, with prospective tenants attracted to the project’s location adjacent to the Edmondson Park train station.

The developer said it had sold 230 apartments at Ed.Square, with investors making up around 40 per cent of the buyers.

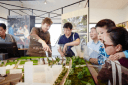

Ed.Square is a multi-stage mixed-use precinct, which will comprise more than 1,800 dwellings across a mix or apartments, terraces and townhouses once complete.

The precinct will also include a full-range Coles supermarket, a cinema complex and a range of hospitality offerings.

Frasers national property manager Richard Kemp said he had been surprised by the swift uptake of apartments at Ed.Square, considering the context of the COVID-19 crisis.

“We started advertising a registration of interest for prospective tenants, and we were quite overwhelmed with the response that we got in the time leading up to the grand opening of the apartments,” Mr Kemp told Australian Property Investor Magazine.

“The project is literally right on Edmondson Park station, so the proximity to the station was a key attractor. And if you look at what’s coming in there, there are movie theatres and an eat street, that gives it real appeal and brings an inner city vibe to the outer suburbs.

“There were a lot of younger people looking for that type of accommodation while staying in the area that they’ve been brought up in.

“And there are really not a lot of other offerings around there, the closest would be Liverpool, there’s a development there called the Paper Mill, which is a similar-style development but it doesn’t have the access to the train station that we do.”

Mr Kemp said investors were also attracted to the location of Ed.Square, with rental vacancies in Sydney’s outer ring less than half of that in the inner-city at 2.6 per cent.

In Sydney's inner ring, REINSW said rental vacancies were 5.8 per cent at the end of June, up from 3 per cent at the same time last year.

“There is a lot of oversupply of stock closer to the city, in certain suburbs where rents are struggling a little bit,” Mr Kemp said.

“It’s well documented that rents in the inner-city have tapered off considerably, but surprisingly, if you look at the vacancy rates that are published by the Real Estate Institute of NSW, you will actually see that the outer regions are the ones that are performing the best.

“We’ve got a portfolio out at Blacktown that we manage, at an estate called Fairwater, and our vacancy rate is 0 per cent.

“And if you go closer into the city, at Central Park which is just near the university there and because it is so heavily reliant on students, our vacancy rate is sitting around 6 per cent.

“There is a big difference.”

Mr Kemp said the other attractor for tenants and buyers alike was the additional amenity on offer at the Ed.Square project, with hospitality and retail offerings in close proximity expected to be a top priority as Sydney emerges from the COVID-19 crisis.

“We’re creating a community, and not just building an apartment block next to a station,” he said.

“If you create a community, it’s somewhere that people want to be. There is more than just a Coles there, there is an eat street, there are outdoor areas, it was a really good master plan and people want to be a part of it.

“I have no doubt that our project teams will see the success of this and it will shape their future acquisitions.

“If there is an opportunity in the immediate area, I can’t see why they wouldn’t look at it.”

Article from realestate.com.au: https://www.apimagazine.com.au/news/article/tenants-investors-descend-on-south-west-sydney/